Business loss claims

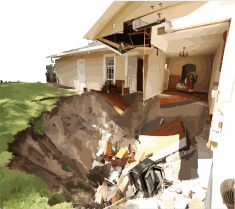

Got Damage?

Send us a message and find out what it’s worth!

Starting a New Claim?

Understand the “claims process” at Indemnify. We will assist you throughout until you receive the correct cash settlement.

Denied a Claim?

If the claim was previously denied, revisiting the case and proposing a re-evaluation of the insurance provisions and terms is not an issue.

Too Low of an offer?

Indemnify will request a reappraisal of the claim if the insurance company has made a lower initial offer than anticipated.

Business Income Loss

When discussing a loss, the topic of business disruption is possibly the most delicate. The blood that keeps the heart and body alive is akin to a person’s business. Almost everything a person needs to maintain himself and his family is frequently related to his or her business.

It doesn’t end there, though. Not only is future income tethered, but deliverables may have been tampered with, and a business owner may find themselves in debt.

The business interruption period usually ends when the physical damage to the property is rectified, and the operation is returned to normal as it was before the tragedy.

Realistically, it takes some time for a business to make up for missed time and lost revenue. As a result, most plans include an “extended period of liability” so that the business owner can return to normal working circumstances for a longer length of time. Though the duration of these plans varies, one year or less has become the industry standard among coverage issuers.

Loss of business income is a major problem that can strike at any time. Each instance is unique, depending on the nature of the business and the circumstances. Indemnify, on the other hand, has a clear road map for properly analyzing the damage and representing the company during an insurance claim for business revenue loss.

Before an interruption, let’s review your policy. That is why it is critical to study your policy before a loss in order to understand what you have agreed to. Unfortunately, some commercial renters purchase slip and fall plans that do not cover business interruption. Let us advise you to ensure that you can get back to work as soon as possible.

INFORMATION NEEDED WHEN FILING A CLAIM

When filing a claim for business interruption, attempt to have as much of the following information on hand as possible:

Policyholder information: Name of insured, address, phone number, e-mail, and policy number.

Description of loss: Time and date of loss, location of the incident, and a detailed description of damages.

Authority notification: Please note all authorities notified (fire dept., police, etc.).