Lightning damage claims

Got Damage?

Send us a message and find out what it’s worth!

Starting a New Claim?

Understand the “claims process” at Indemnify. We will assist you throughout until you receive the correct cash settlement.

Denied a Claim?

If the claim was previously denied, revisiting the case and proposing a re-evaluation of the insurance provisions and terms is not an issue.

Too Low of an offer?

Indemnify will request a reappraisal of the claim if the insurance company has made a lower initial offer than anticipated.

How to prove that insurance damage was caused by lightning

You’ll need to provide evidence to support your claim that lightning harmed your house and possessions. As soon as it is safe to step outside, take pictures of any holes, char marks, or other damage to your home’s exterior.

The electrical and plumbing systems of your house, however, can be harmed by a ground strike close to your house. In your yard, you might also want to keep an eye out for and photograph any char marks and holes.

Calling the appropriate plumbers and/or electricians to come out and inspect the damage is the next step. They can estimate the cost of any required replacements or repairs and offer evidence that the damage was brought on by a lightning strike. Both of these things must be provided when making a claim with your insurance provider.

Lightning strikes can result in electrical problems that affect the entire household, or anything plugged into the outlets. It’s typical to lose important appliances that are plugged into the electricity or are wired into your house, such your water heater or air conditioner. In order to make a full claim, make sure you examine each of these items.

Does Florida, texas, & Louisiana Insurance Cover Lightning Damage?

It is true that lightning damage is covered by homeowners insurance. Insurance companies, however, will always fight back against claims related to lightning strikes. Homeowners insurance claims for hurricane damage can be problematic, as the majority of property owners have learned the hard way in the past.

Insurance companies are quick to reject lightning insurance claims because they claim that many of the things you’ve claimed were destroyed weren’t actually harmed by the strike or that there is no evidence that a strike ever took place. It is the homeowner’s responsibility to demonstrate that a lightning strike actually took place and that the damage was a direct result.

Examples of lightning damage include:

- Humming Sounds

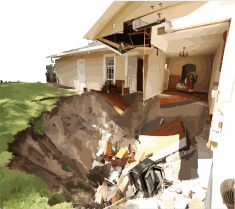

- Physical Damage to the Property

- Sparks or Fire

- Smoke

There could be an unusual scent, perhaps like melting plastic. Lighting strikes have the potential to seriously harm a building’s structure and its contents.

What to do if you discover lightning damage?

It is in your best interest to speak with a property damage public adjuster if you need to file a claim for lightning damage to your house or car. A public adjuster can ensure that the insurance provider compensates for your loss and complies with the provisions of the policies they have in place.

Indemnify is aware of the methods insurers use to delay paying out on claims. Your public insurance adjuster will see to it that you are treated properly by the insurer and are given the money you require to fix or replace any damaged things inside or outside of your home.

Florida, Texas, Louisiana lightning damage claims

Lightning is a reality of life for anyone who resides in Florida, Texas, or Louisiana. When your home or vehicle has been harmed by lightning, you do not have to deal with an insurance company not upholding their policies, though. The property damage public insurance adjusters at Indemnify may be able to assist you if you’re experiencing trouble with an insurance claim. Get in touch with us right now for a free consultation.