tornado damage claims

Got Damage?

Send us a message and find out what it’s worth!

Starting a New Claim?

Understand the “claims process” at Indemnify. We will assist you throughout until you receive the correct cash settlement.

Denied a Claim?

If the claim was previously denied, revisiting the case and proposing a re-evaluation of the insurance provisions and terms is not an issue.

Too Low of an offer?

Indemnify will request a reappraisal of the claim if the insurance company has made a lower initial offer than anticipated.

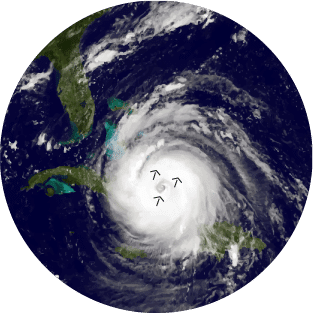

We Know Tornado damage in Florida, Texas, & Louisiana

Tornado damage is an undesirable but inevitable event in the south states of Florida, Texas, & Louisiana. In reality, homes will never be able to completely avoid Tornado damage. Certain measures must be taken against thunderstorms, tornadoes, or hurricanes that are common. As a homeowner in any region, you are well aware that tornado damage may cost hundreds, if not millions of dollars.

The first thing you’ll want to do if you’re caught in a tornado is make sure you and your family are safe. Ensure that your lawn furniture, as well as your vehicle, is stored in your garage(s). ‘Falling items’ is the most prevalent type of wind damage, such as when a tree falls on your house.

More than a quarter of all homeowners have filed tornado damage claims with their insurance providers. Using a public adjuster might be the difference between accepting whatever your insurance company offers and obtaining the full amount required to pay the damage.

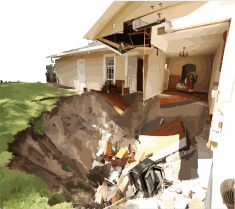

You may also experience tornado damage such as:

- Gutters and siding damaged

- Homes shifted off their foundation

- Mobile homes overturned or severely damaged

- Roof shingles blown off

- Several sections of your roof have been torn off

- Structural damage

How to make the most of your tornado damage insurance claim

Every year, violent tornados pound the U.S., leaving homeowners and business owners with the task of removing debris from their properties and planning for repairs. Tornado damage may range in intensity, from strong winds that can collapse trees to golf ball-sized hail that can dent your car, shatter your skylight, and cause other problems.

Repair estimates for wind or hail damage can be expensive. Fortunately, Indemnify will assist you in filing your insurance claim. The skilled public adjusters at Indemnify are used to dealing with insurance companies. It’s critical to follow certain actions after a tornado to ensure that you get the most out of your insurance claim.

Indemnify can assist you in deciphering the fine print in your policy and will work with you to construct a strong claim so that you receive the highest potential settlement. After your house has been damaged by a tornado, Indemnify will handle the rest and make sure that your home is taken care of.

Florida Indemnify public adjusters

As soon as your house or place of business sustains tornado damage, get in touch with Indemnify. A group of seasoned public adjusters working for Indemnify are happy to offer free inspections.

Indemnify provides clients with four locations to better serve communities throughout the states of Florida, Texas, & Louisiana.

Contact Indemnify Public Adjusters today to schedule your free inspection and learn more about your next steps after a tornado.