Fire damage claims

Too Low of an offer?

Indemnify will request a reappraisal of the claim if the insurance company has made a lower initial offer than anticipated.

Denied a Claim?

If the claim was previously denied, revisiting the case and proposing a re-evaluation of the insurance provisions and terms is not an issue.

STARTING A NEW CLAIM?

Understand the “claims process” at Indemnify. We will assist you throughout until you receive the correct cash settlement.

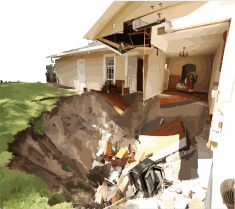

Fire damage

Fire damage refers to the destruction, harm, or impairment caused by fire to objects, structures, or the environment. When a fire occurs, it can cause various types of damage depending on its intensity, duration, and the materials involved.

Here are some common forms of fire damage

- Structural Damage: Fires can weaken or destroy the structural integrity of buildings, houses, or other constructions. The heat and flames can cause materials like wood, metal, or concrete to warp, melt, or collapse.

- Smoke Damage: Smoke produced during a fire can leave residues and soot on surfaces, walls, and ceilings. It can also seep into fabrics, furniture, and belongings, causing discoloration, staining, and unpleasant odors.

- Heat Damage: Intense heat from a fire can melt or warp materials, causing permanent damage to objects, electronics, and appliances.

- Water Damage: In many cases, water or fire suppressants used to extinguish the fire can cause additional damage to the affected area or belongings.

- Loss of Possessions: Fires can consume or damage personal belongings, furniture, and valuable items, resulting in significant loss.

- Environmental Impact: Large fires can have adverse effects on the environment, such as deforestation, air pollution, and harm to wildlife.

Restoration and recovery after fire damage can be a challenging and costly process, depending on the extent of the destruction. Many people rely on insurance and professional restoration services to help recover from fire incidents. Taking preventive measures, such as installing fire alarms, having fire extinguishers, and implementing fire safety plans, can reduce the risk of fire damage and ensure safety in case of emergencies.

Even a mildly burned kitchen, where only a little piece of cabinet has been damaged in a stove top fire, meets your policy’s requirements for claiming a fire loss and having your kitchen replaced. Remember, whether it’s a fire caused by neglecting the frier while making french fries, a toddler knocking over a candle, or holiday lights causing an electrical fire, these are all covered by your insurance.

Fire damage insurance claim process

The fire insurance claim process involves several steps to ensure a smooth and timely resolution of your claim. Here’s a general overview of the steps you can expect when filing a fire insurance claim:

Contact Your Insurance Company: As soon as possible after the fire incident, contact your insurance company or your insurance agent to initiate the claims process. Provide them with essential details, such as the date, time, and location of the fire, as well as a description of the damages and losses incurred.

Document the Damage: Take photographs and videos of the damage caused by the fire. Create a detailed inventory of the items that were damaged or destroyed, including their approximate value. This documentation will be crucial in supporting your claim.

Prevent Further Damage: If possible and safe to do so, take reasonable steps to prevent further damage to your property. For example, cover exposed areas with tarpaulin or secure the property to prevent unauthorized access.

File a Proof of Loss: Your insurance company will likely require you to submit a “proof of loss” form, which is a detailed statement of the items damaged or lost, along with their estimated values. This document serves as a formal request for compensation.

Cooperate with the Claims Adjuster: An insurance claims adjuster will be assigned to your case to assess the damage and investigate the circumstances of the fire. Cooperate with them, provide any necessary information, and answer their questions to the best of your knowledge. If you do not know the answer, a simple “I do not know” will suffice.

Get Repair Estimates: Obtain repair estimates from reputable contractors for the damages to your property. Or work with us, we use the same estimating software as the insurance companies, giving you a fair evaluation. These estimates will help your insurance company determine the appropriate compensation.

Temporary Living Arrangements: If your home is uninhabitable due to the fire, check if your policy includes coverage for additional living expenses. This coverage can help you with the costs of temporary accommodations and essential living expenses during the repairs.

Review Your Policy: Familiarize yourself with the terms and conditions of your insurance policy, including coverage limits and exclusions. Understanding your policy will help you know what to expect during the claims process.

Settlement and Compensation: Once the claims adjuster assesses the damages and reviews all relevant documentation, your insurance company will make a settlement offer. If you agree with the offer, you’ll receive compensation for the covered damages and losses. If you disagree with the settlement, you may negotiate with your insurer or file an additional payment.

Remember that the fire insurance claim process can vary depending on your specific insurance policy, the extent of the damages, and local regulations. It’s essential to review your policy and consult with your insurance company or a professional insurance agent for guidance throughout the process.

Smoke damage and how to get rid of it from my house

Smoke damage can occur after a fire or even from prolonged exposure to smoke from sources like cooking or tobacco. Removing smoke damage from your house is crucial to restore the indoor air quality and eliminate odors. Here are steps to help you get rid of smoke damage:

Safety First: Before attempting any cleaning, ensure the house is safe to enter. If the fire was severe, have a professional inspector assess the structural integrity.

Ventilation: Open all windows and doors to improve air circulation and let fresh air in. Use fans and air purifiers to help remove smoke particles from the air.

Personal Protective Equipment (PPE): Wear appropriate PPE, including gloves, safety goggles, and a respirator mask, when dealing with smoke-damaged areas.

Wash Fabrics: Launder all washable fabrics, including clothing, curtains, and linens, using hot water and a strong detergent. For non-washable items, consider professional dry cleaning.

Clean Upholstery: Vacuum upholstered furniture using an upholstery attachment, and consider using a fabric-safe smoke odor neutralizer to remove lingering smells.

Clean HVAC System: Have your HVAC system inspected and cleaned by professionals. Smoke particles can get trapped in the system and spread throughout the house when the system is running.

Clean Carpets and Flooring: Professionally clean carpets and rugs, or consider replacing them if the damage is severe. Wash hard flooring with a mixture of water and vinegar to remove smoke residues.

Clean Personal Belongings: Clean and deodorize personal belongings, such as books, electronics, and toys, using appropriate cleaning methods and products.

Paint and Seal: In some cases, repainting walls and ceilings with a primer specifically designed to block smoke odors may be necessary. Seal porous surfaces, such as drywall, to prevent smoke odors from penetrating.

Ozone Treatment: Consider using an ozone generator to help remove smoke odors from the air. However, ozone generators should be used with caution and only in unoccupied spaces due to potential health risks.

Seek Professional Help: For extensive smoke damage or if you are unsure about how to proceed, it’s best to seek the assistance of professional restoration and cleaning services.

Keep in mind that smoke damage claims can be a complex process, and the severity of the damage may vary based on the extent of the fire or smoke exposure. If the damage is extensive, consider contacting us, who specializes in smoke and fire damage claims to ensure a thorough and safe repair of your home.

Got Damage?

Send us a message and find out what it’s worth!